Unfunded

The impact of unfunded state mandates and public liability on Colorado’s cities and towns

Colorado Municipal League: 2024 State of Our Cities & Towns Report

By Rachel Woolworth, CML municipal research analyst

Graphics by Alex Miller, CML design and publication specialist

The 2024 State of Our Cities & Towns survey, administered from October to November 2023, inquired about the fiscal and operational impacts of public liability from claims, lawsuits, and unfunded state mandates on municipalities across Colorado.

Municipalities reported few changes to local economic performance and municipal revenue from the previous fiscal year. A lack of affordable housing emerged as the top challenge for municipalities going into 2024, followed by unfunded street maintenance and inflation.

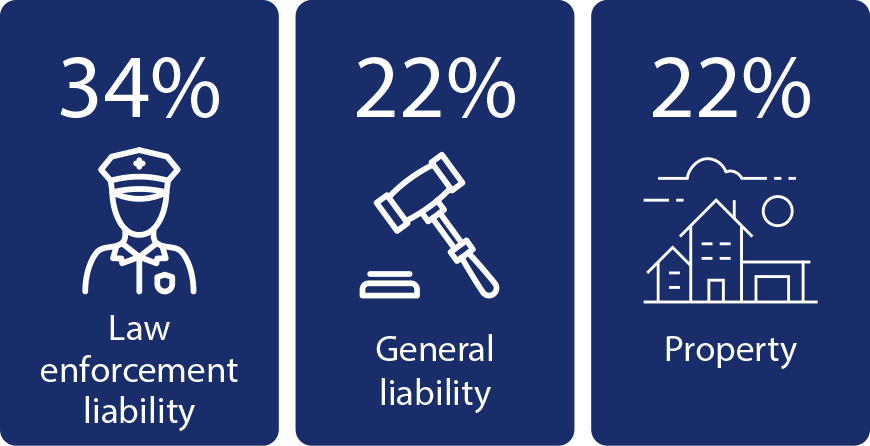

Cities and towns identified the cost of insuring against liability, especially for law enforcement, property, general liability, and auto, as a budgetary challenge. On average, municipalities responded to one to 10 claims and less than one lawsuit annually in the last five years. Generally, municipalities found ways to continue offering services in the face of such legal challenges.

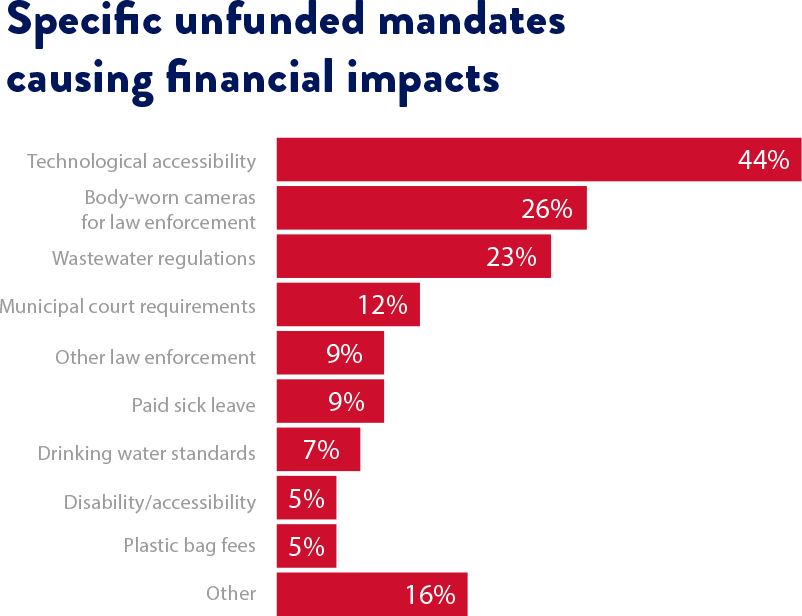

Unfunded state mandates related to technology accessibility, body-worn cameras for law enforcement, and wastewater quality proved difficult for municipalities in 2023. Cities and towns expended extensive fiscal and staff resources to work towards compliance with such mandates.

Responding municipalities

This year, 113 of CML’s 270 member municipalities responded to the survey for a 42% response rate. Cities and towns scattered across the state, from the Eastern Plains to the Western Slope and from the San Luis Valley to the Front Range, shared budgetary data, their experiences with unfunded state mandates, and more. Municipalities of all sizes were represented: 40% of municipalities under 2,000 people, 41% of mid-sized municipalities, and 54% of municipalities over 25,000 people participated. A few of the state’s largest municipalities, such as Denver and Colorado Springs, did not participate in the survey.

Fiscal overview

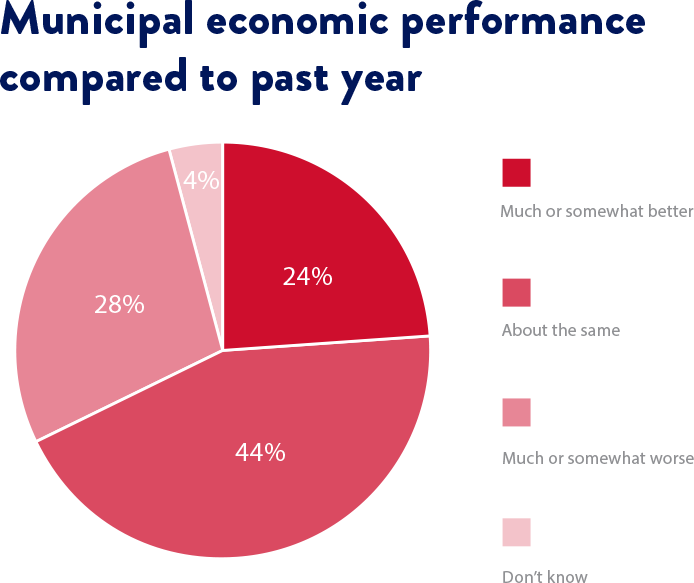

The majority of responding municipalities reported their local economy performing on par with the previous fiscal year. A little over one-quarter of cities and towns identified their economy performing worse than last year. And one-quarter of municipalities reported their economy performing better – a rate that stayed approximately the same across geographic regions and population ranges.

- Municipal economic performance

- Improved economic performance by region

- Improved economic performance by population

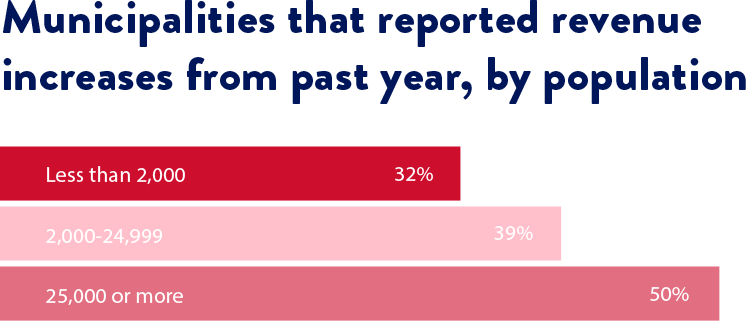

A little over one-third of cities and towns reported municipal revenues improving from the previous fiscal year; a similar share reported municipal revenues staying the same. About one-quarter of municipalities reported revenues worsening from last year. Cities and towns located in the Eastern Plains and municipalities with less than 2,000 people were slightly less common to report revenue improvements.

Investment and interest income, charges for services, property taxes, and sales and use taxes emerged as the top increased revenue sources for responding municipalities. In fact, more than half of cities and towns reported revenue increases from investment and interest income since last year. Additionally, 20% of municipalities reported state funding increases while 20% of municipalities reported state funding decreases.

Throughout the last decade, more responding municipalities have reported better revenues over the previous year than those who have reported worse – with 2020, the year of the COVID-19 pandemic, as the exception. Municipal revenue growth has been on a slight decline since 2021.

Responding municipalities rated the challenges they expect to face in 2024 on a scale of 1 to 4, with 4 representing the most challenge and 1 the least. A lack of affordable housing emerged as the top challenge for municipalities going into 2024, a concern that also topped the list in 2021 and 2022. Unfunded street maintenance and improvements ranked second while inflation, the top challenge for municipalities in 2023, dropped to third on the list.

Other challenges not included in the visual above include decline in state funding (2.6), adverse local economic conditions (2.6), decline in federal funding (2.5), decrease in tax revenues (2.4), TABOR (2.2), and pension contributions (2.1).

Rising costs of insuring municipal operations

Many municipalities purchase liability insurance to protect against unanticipated expenses from lawsuits arising from their operations. Municipalities identified the rising cost of insurance premiums as a challenge throughout 2023 as state laws were changed to impose greater liability, reduce existing protections, and open new avenues to seek damages against public entities and their employees. Cities and towns hold various lines of insurance including but not limited to general liability, property, workers’ compensation, and auto.

According to survey results, the larger the municipality, the more likely they are to hold more lines of insurance, excluding those that remain self-insured. Specifically, cities with populations over 25,000 were more likely to hold law enforcement liability, cyber, and umbrella insurance when compared with smaller towns. CML was not able to verify whether responding municipalities had awareness of all the lines of coverage they retain.

Municipalities also reported holding lines of coverage not included in the survey such as mobile equipment, equipment breakdown, volunteer, excess crime, and flood insurance.

More than 60% of responding municipalities have not shopped for new insurance coverage in recent years. Among those who have shopped for coverage, most cities and towns did not face barriers to finding insurance.

For those municipalities who did face challenges, law enforcement liability and cyber insurance emerged as the most challenging lines of coverage to access, with almost half of cities and towns on the market for such insurance facing accessibility issues.

Common challenges encountered by municipalities looking for adequate insurance coverage include not having time to shop, not finding sufficient limits, and not being able to find an insurer to cover properties.

“No one wants to provide sufficient limits for law enforcement at a premium the city can afford.”

– Home rule city, Front Range

“We don’t have time to shop.”

– Statutory city, Eastern Plains

“We had a local insurance agent quote our insurance and they can’t even find an insurer who would insure our properties.”

– Statutory town, Mountains/Western Slope

“There are many comparable insurance companies who offer similar coverage and rates, making it hard to shop for workers’ compensation coverage. Law enforcement liability is also a challenge with large agencies experiencing claims and situations that have granted large payouts. This affects the insurance industry for smaller agencies who don’t see the same types of risks but there isn’t anywhere else to shop coverage because of state legislation.”

– Home rule city, Front Range

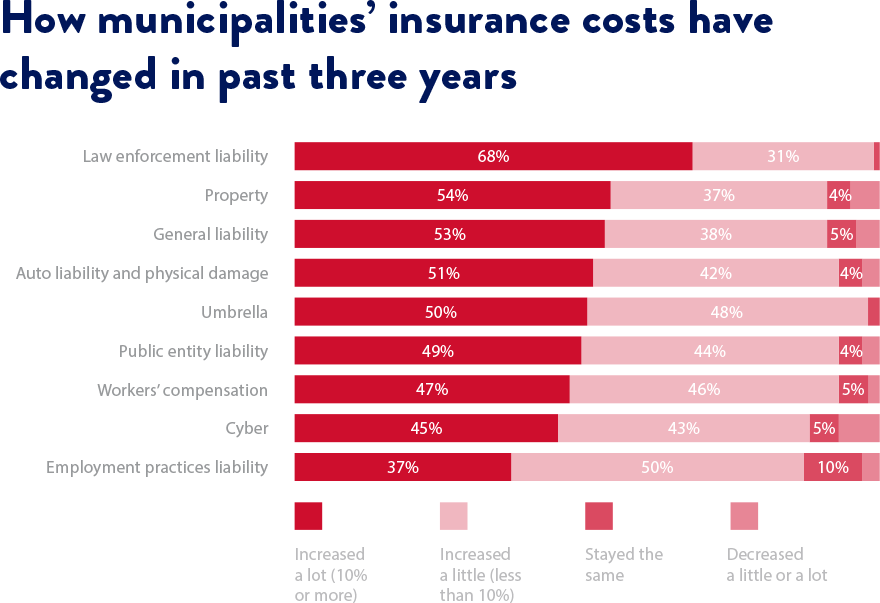

Most responding municipalities reported increases in insurance premium costs across various lines of coverage in the last three years. Specifically, more than 50% of responding municipalities reported price increases of 10% or more for law enforcement liability, property, general liability, and auto liability and physical damage. Few municipalities reported insurance premiums decreasing in cost.

When asked what lines of coverage incurred the greatest increases in cost over the last three years, the following rates of municipalities, regardless of holding the line of coverage, reported:

More than 75% of municipalities reported that self-insured retention rates, the dollar amount paid by a city or town before the insurance carrier covers costs, did not increase for various lines of coverage over the past three years.

That said, mid-sized and large municipalities were more likely to see increases in self-insured retention rates than small towns. Such rate increases were reported most frequently for general liability, auto liability, and law enforcement liability. The City of Arvada, for example, saw its self-insured retention rate for law enforcement liability double last year.

About 70% of responding municipalities have not taken any action in response to increasing insurance costs in recent years. Of the cities and towns that have attempted to lower insurance costs, they reported taking the following actions:

- Changed insurers

- Increased self-insured retention amounts

- Removed lines of coverage

- Reduced coverage limits

- Conducted risk mitigation

Public entity liability

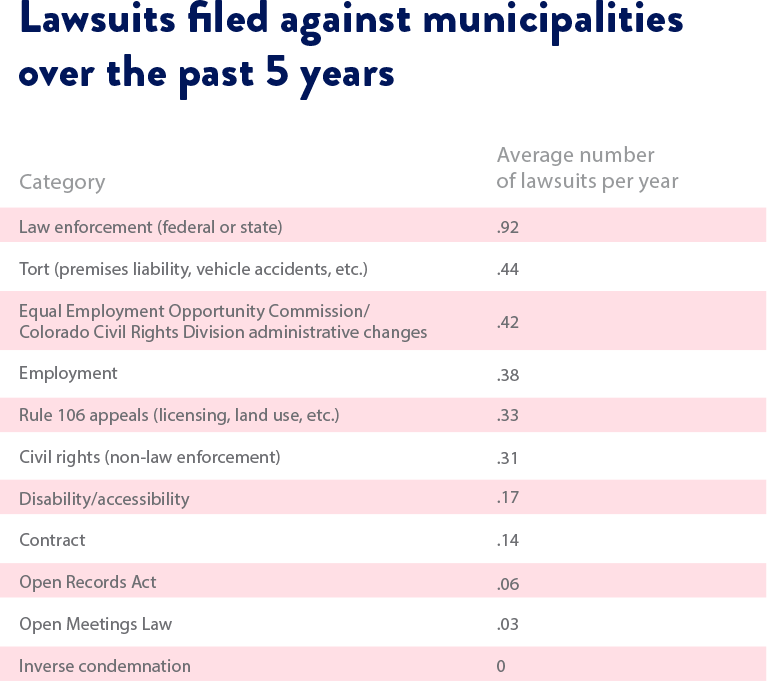

Legal actions were another challenge identified by municipalities throughout 2023, measured by notices of claim that must precede certain types of lawsuits under the Colorado Governmental Immunity Act, as well as lawsuits themselves. Law enforcement related lawsuits emerged as the most common type of litigation filed against municipalities.

The majority of responding municipalities received, on average, one to 10 notices of claims annually throughout the last five years. About half of cities and towns reported that the quantity of claims filed against them has stayed roughly the same over the same period. The survey did not determine whether these notices presented valid claims or how claims may have been resolved.

On average, less than one lawsuit was brought against responding municipalities across most potential areas of liability annually throughout the last five years. Such lawsuits could have been filed and served against a city or town, its officials, or its employees. The quantity of lawsuits filed against municipalities has stayed roughly the same in recent years. The survey did not determine the validity of any suits or whether any claims were resolved without litigation.

Law enforcement related lawsuits were the most common type of litigation encountered by responding municipalities over the last five years. One or more law enforcement lawsuit(s) were filed against about 30% of municipalities annually in recent years.

Small municipalities with less than 2,000 people were less likely to encounter law enforcement related lawsuits than mid-sized and large cities and towns. A few large cities located on the Front Range reported an average of five or more law enforcement lawsuits annually.

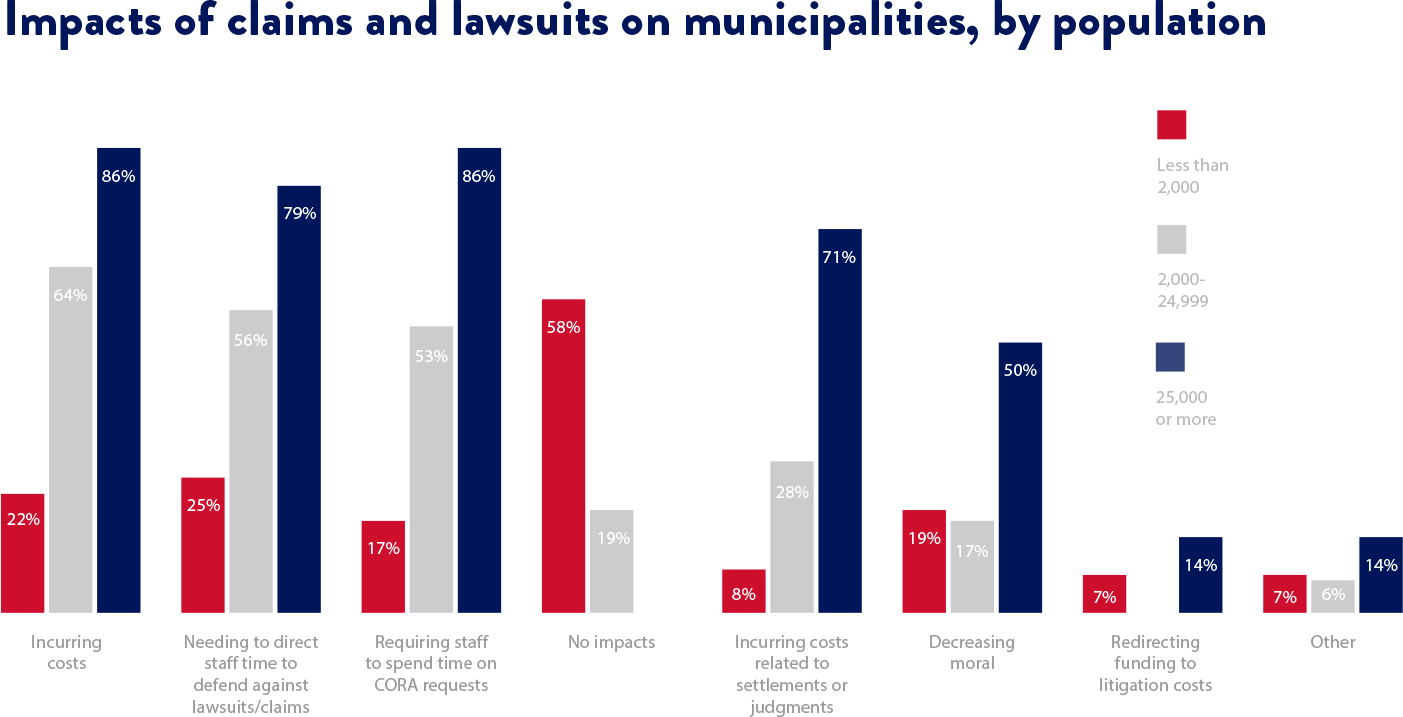

While many responding municipalities did not report any consequences stemming from notices of claim or lawsuits, some cities and towns identified impacts such as incurring costs related to legal defense, needing to direct staff time to legal defense and to Colorado Open Records Act (CORA) requests, and sustaining costs related to settlements. Municipalities with larger populations were more likely to face impacts related to claims and lawsuits.

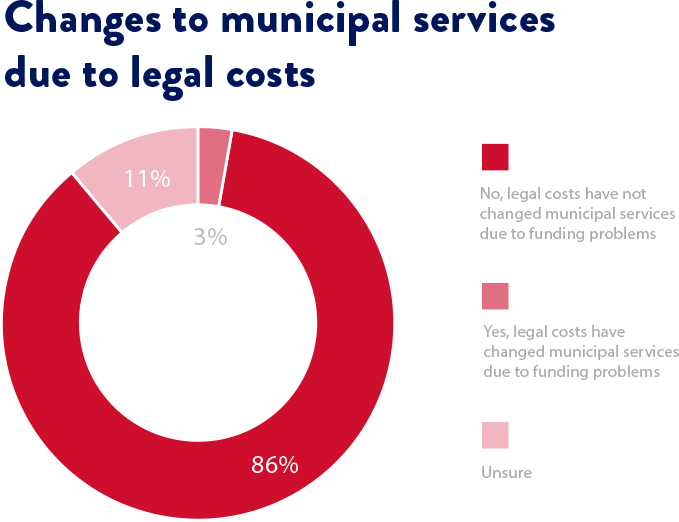

Few municipalities reported intentionally changing municipal services because of the costs of judgments, settlements, or litigation. The small number of cities and towns that did report related impacts noted that legal costs directed funding away from basic municipal services. The survey did not determine whether municipal budgeting decisions were indirectly influenced by litigation costs.

“Increased allocation of costs takes away funding from other potential programs and services. Inability to collect restitution under CRS 18-1.3-603(8) impacts the ability to recover costs and maintain reserves.”

– Home rule city, Front Range

“Some years we spend more funds on litigation or the threat of litigation than on basic municipal services.”

– Home rule Town Front Range

Compliance with state mandates

Municipalities across Colorado are currently facing the challenging fiscal consequences of various unfunded state mandates. A state law that generally prohibits the practice (C.R.S. § 29-1-304.5) lacks adequate recognition, meaning state laws or regulations often result in municipalities taking prescribed actions to achieve state policy goals without any reimbursement for the city or town from the state that the law otherwise requires.

About 45% of responding municipalities reported being aware of the financial impacts of unfunded state mandates over the last five years. Generally, the larger the municipality, the more awareness a city or town has of such mandates. One hundred percent of large cities (over 25,000 people) participating in the survey reported awareness of unfunded state mandates while only 29% of small municipalities (under 2,000 people) reported such awareness.

The State of Colorado’s recent unfunded mandates regarding technology accessibility, body-worn cameras for law enforcement, and wastewater quality emerged as the most common laws and regulations to financially impact responding municipalities.

Just one in seven responding municipalities reported local projects being affected due to a lack of funding due to unfunded state mandates. In fact, more than 50% of responding cities and towns said that such mandates have not impacted funding for municipal projects. The survey could not determine whether municipal budgeting decisions or operations were indirectly influenced by the fiscal and staffing costs of compliance with state mandates.

“We’ve had to cut or opt to not pursue a number of programs due to escalating costs associated with law enforcement liability insurance (possibly due to SB 20-217) and ADA web compliance. In particular, we cannot afford to add police and other public safety staff due to cost escalations associated with these programs.”

– Home rule city, Front Range

“Although there was no financial outlay associated with the state’s plastic bag ban, we did expend (and continue to expend) valuable staff time working with businesses to comply with the mandate and collecting fees, which are far less than what we have spent on additional staff time.”

– Home rule city, Mountains/Western Slope

“We never have enough money to fund all the needs. Unfunded mandates exacerbate the issues affecting our ability to balance sources and uses of funding.”

– Home rule city, Front Range

Municipalities reported taking various steps to better comply with unfunded state mandates. Common actions included updating technology, increasing staff training, and relying on outside vendors to perform services.

More than 50% of responding cities and towns reported relying on existing funds to pay for the actions, such as updating technology and increasing training, described above. One-third of municipalities applied for grant assistance to help respond to unfunded state mandates while just under one-third diverted funds away from other municipal programs or services to do so.

The following section will investigate impacts of the three unfunded state mandates most commonly affecting Colorado’s municipalities: laws and regulations addressing technology accessibility, body-worn cameras for law enforcement, and wastewater quality.

House Bill 21-1110: Technology accessibility

HB 21-1110, passed by the state legislature in 2021 and amended in 2023 by SB 23-244, strengthened protections against discrimination based on disability, specifically for laws relating to government information technology accessibility. The law requires state and local public entities, including municipalities, to meet sweeping technology accessibility standards, such as offering text descriptions of images and transcriptions of video and audio content. Any public entity that fails to meet such web accessibility standards by July 2024 could face legal and financial consequences. The laws excluded local governments from state technical and financial support.

Responding cities and towns reported that compliance with HB 21-1110 will cost between $5,000 and $800,000. Most municipalities, especially large cities, said they will rely on existing funding to finance compliance with the web accessibility law. About 20% of responding municipalities reported applying for grant assistance while 15% said they diverted funds away from other programs and services to pay for such efforts. State regulators are currently conducting rulemaking to implement the law and municipalities likely have not determined the full cost of compliance.

“The total cost of responding to the requirements of HB 21-1110 are still accruing as city staff continues to work toward the state’s July 1, 2024 deadline for accessibility. So far, costs include significant ongoing staff time, in-depth accessibility training across the organization, subscribing to and acquiring accessibility software products and licensing, and hiring an outside vendor to analyze the city website and remediate documents.”

– Home rule city, Mountains/Western Slope

“This website accessible mandate has reduced municipal transparency as we reduce items on our website to avoid costly retrofits.”

– Home rule town, Front Range

“The law has cost the town a minimum of $9,000 to audit our website. We are uncertain of total costs at this point, but the town has expended hundreds of hours of staff time working towards compliance.”

– Home rule town, Mountains/Western Slope

“We have spent approximately $150,000 per year plus lots of staff time on HB 21-1110 since its passage. This is a huge labor and technological burden for the city, and we are nowhere close to compliance.”

– Home rule city, Front Range

Senate Bill 20-217 and House Bill 21-1250: Body-worn cameras for law enforcement

SB 20-217 and HB 21-1250, passed by the state legislature in 2020 and 2021 respectively, strengthen law enforcement accountability throughout the state. SB 20-217 requires all local law enforcement agencies to issue body-worn cameras to officers and to follow specific procedures, among other reforms, while HB 21-1250 clarifies and addresses issues discovered after the passage of SB 20-217, such as the release of body-worn camera footage and state reporting requirements. Body-worn camera programs costs can include hardware and software, personnel, training, and data storage. While many agencies had implemented body-worn camera programs before 2020, responding cities and towns reported that compliance with SB 20-217 and HB 21-1110 has cost between $17,000 and $2.3 million annually.

“The state requirements to purchase and maintain body cameras for law enforcement included approximately $50,000 in initial costs and $3,500 annually in support costs.”

– Statutory town, Eastern Plains

“These laws have cost our police department over $300,000 through a five-year payment plan. There are likely other unfunded mandates that have incurred additional costs and, more importantly, staff time.”

– Home rule city, Front Range

“Our agency currently pays approximately $17,000 annually in order to follow body-worn camera mandates, associated video redaction rules, and other law enforcement reporting requirements.”

– Statutory city, Mountains/Western Slope

CDPHE wastewater quality regulations

Colorado Department of Public Health & Environment (CDPHE) maintains a variety of wastewater quality regulations for wastewater infrastructure across the state, including municipal systems. Specifically, Regulations 85 and 31 work to limit phosphorus and nitrogen discharge from wastewater treatment plants. These regulations were cited in the survey as significantly impacting municipal budgets. Responding cities and towns with municipal wastewater systems anticipate that they will spend $80,000 to $50 million on wastewater infrastructure to stay in compliance with such CDPHE regulations.

“The city is currently in the process of constructing improvements to its wastewater treatment facility to comply with Reg. 85 and 31. The total project cost, not including ongoing operation and maintenance, is estimated at over $47 million dollars. Because annual revenue for the city’s wastewater utility enterprise is approximately $5 million, the city had to take on a 30-year debt term to manage impacts to ratepayers. Further, this mandate diverts limited staff and financial resources away from operation and maintenance of existing wastewater infrastructure.”

– Home rule city, Front Range

“CDPHE rule changes for preliminary effluent limitations have made it difficult to operate our wastewater plant and the upgrades needed to meet stricter discharge conditions are cost prohibitive.”

– Statutory town, Mountains/Western Slope

“Under CDPHE requirements, our wastewater treatment plant will likely need to be upgraded to a level higher than our water plant.”

– Home rule town, Front Range

2024 will undoubtedly bring successes and challenges for Colorado’s cities and towns. As communities across the state grow and evolve, CML is committed to helping municipalities continue to seek creative solutions to problems discussed in this report such as a lack of affordable housing, rising insurance costs, and compliance with unfunded state mandates.